Credit Score: 752

One whole year in our house today and I have updates for you!

First off, my credit score is back to "Excellent" according to Credit Karma:

It even says I've "done an excellent job" managing my debts. : ) And I'm now only 7 points below my original credit score from over two years ago.

I

pulled my TransUnion report just this month to check how everything shook out. (I

check all three evenly throughout the year - TransUnion was

coincidentally July AND the report that Credit Karma reads.) It does

show the foreclosure, lots of months of missed/late payments and now

shows them as "derogatory marks," but also shows 100% on-time payment

history. OK. Fine by me!

As for the two IRS arguments I mentioned in

the last post, they're both FINALLY resolved, as of last week. How

opportune. I didn't record when the first argument got resolved, but the

IRS did finally agree with me last year sometime that I did not owe them the

$500 for the final payment of the First Time Home Buyer's Credit for 2012

taxes. I continued to exchange letters (with varying levels of

politeness) over the issue of amending my 2011 taxes and my extremely

foolish pre-payment of half the credit. NEVER give the IRS more money

than you have to, guys! I've no idea what possessed me. But after months

of arguing with them, half a dozen letters from me to them, and more

than a dozen letters from them to me including three denials and

two different spellings of my last name, I finally got an interesting

letter a few months ago.

They did not have "enough evidence" to

determine either way. Not enough evidence? Really? Perhaps a result of them

spelling my name two ways, or perhaps bad government record keeping, or

just a consequence of being a large bureaucracy, but evidence is something I can fix! I printed up a copy of every single paper related to

the First Time Home Buyer's Credit, my pre-payment of it, my original

2011 return, my 2011 amendment, a letter of what I again wanted, and

little ink arrows and circles all over each page so they couldn't

miss my point. (It had to be paper because you can't email these guys;

you can't fax them; and when you do call, you just get customer service

who only reads notes on their computers and can't make decisions.)

And

it worked! Or they just got sick of me. Two weeks ago, I got a letter saying they agreed with me,

and one week ago I got a check for the full return of my overpayment

PLUS interest. Apparently I'm entitled to interest for the time the IRS

had "my" money.

Other than buying the sad little condo in the first place,

pre-paying the IRS $3000 was probably the biggest financial mistake I'd

ever made. But now, after a year in my wonderful home and a refund check

safely deposited, I've recovered from both and I sure hope I don't make

any more.

I also hope that this blog has helped you avoid some financial mistakes of your own. Thank you so much for reading!

Sincerely,

Jane

Schrödinger's House

Is it foreclosed yet?

Wednesday, July 16, 2014

Tuesday, July 16, 2013

Day 502 - Riding Off Into The Sunset

We bought a house! We’re moving in tomorrow and couldn’t be happier.

We started house hunting in March and walked through more than 100 houses before finding this really great one. It was a long, frustrating process and I hope to never need this information again, but perhaps you'll find it useful.

We started off getting a general idea of what we could afford by looking at our budget and how much we could spend per month on mortgage, taxes, and insurance. I played with the Quicken Loans Mortgage Calculator mobile app a LOT over the last three months, and got an idea from that on how much house our monthly budget meant. It seemed to us that the industry really doesn't look at the numbers that way. They do it backwards. They look at your overall income - not your take home pay - and then calculate a house value. I can't imagine why that's a good idea for the buyer, but we quickly got the impression that nothing in the mortgage industry is intended to be good for anyone but the banks. (*cough cough* mortagecrisisain'tfixedyet *cough* Oh, excuse me)

Anyway, we got an idea from the Quicken app of what we could afford and what we could be preapproved for. We could've been approved for more house than we could actually afford, but didn't want that. We like eating out, we like our cell phones, we like fast internet and we like not pinching pennies. Our theory was that if we can't afford a house and our current lifestyle, then we can't afford the house. I'd much rather shrink our budget and pinch pennies when a pipe bursts, than to have a pipe burst when we've already shrunk our budget and have to live off credit cards to pay for the repairs. However, I also really like adorable little craftsman houses, and had to figure about what price range we'd find a forever home within. Luckily, they both lined up pretty well - in March at least.

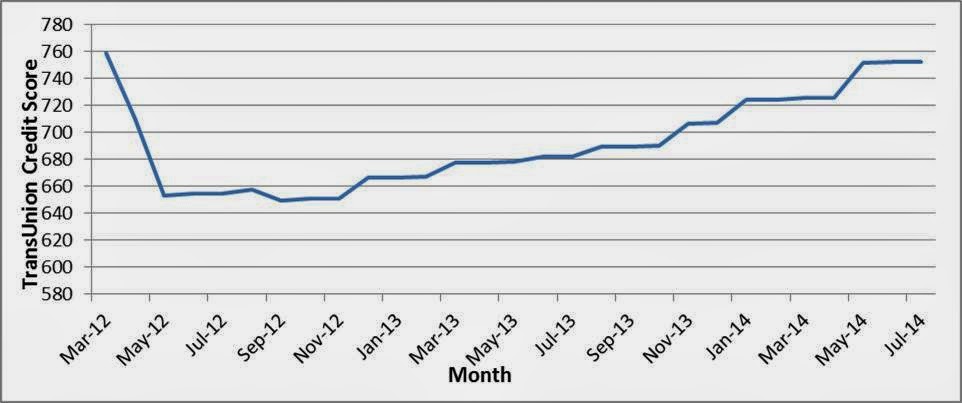

We only used Corey's income to qualify for the mortgage. My credit score and credit report would've significantly increased our interest rate, if not had us denied entirely. None of them minded only using Corey's, or even batted an eye. I can't imagine how much money the banks would've pretended we could afford if they'd actually looked at both our incomes. Something ridiculous that would've meant nothing but ramen for five years. But now that I’m more than a year passed my first missed payment on the mortgage, here’s how my credit is shaping up:

I don't know if my zero missed payments is an error, or if having the mortgage "closed as agreed" meant the missed payments got wiped out. I decided not to investigate. :) I had expected that the foreclosure would've shown up as a "derogatory mark" but still nothing.

Back on the house hunt, we'd only gone to a handful of open houses before finding an agent we liked at one and decided to work with her. She recommended we immediately get formal pre-approvals. So in early April, we talked to Quicken, Wells Fargo, and a mortgage broker she recommended, and requested they pre-approve us for the amount I had planned. They did all tell us we could get approved for more, but we didn't want it. It felt a little like feeding in to the slimey mortgage industry to let them tell me my own budget. Also on the recommendation of the agent, if your preapproval letter says you can afford $50,000 more than what you bid a house, a seller will know you can afford to raise your offer. We were happy with our pre-planned amount.

Back on the house hunt, we'd only gone to a handful of open houses before finding an agent we liked at one and decided to work with her. She recommended we immediately get formal pre-approvals. So in early April, we talked to Quicken, Wells Fargo, and a mortgage broker she recommended, and requested they pre-approve us for the amount I had planned. They did all tell us we could get approved for more, but we didn't want it. It felt a little like feeding in to the slimey mortgage industry to let them tell me my own budget. Also on the recommendation of the agent, if your preapproval letter says you can afford $50,000 more than what you bid a house, a seller will know you can afford to raise your offer. We were happy with our pre-planned amount.

Now we had pre-approval letters in hand, we had an agent to show us through houses, and I had a real estate mobile apps to show me every single house in our neighborhoods and price range. Weekend after weekend after weekend, we'd tour about 10 houses, and a handful more on weekday evenings. We saw lots of diamond-in-the-rough houses that we couldn't afford to make amazing, but saw the potential. Saw lots of cute tiny houses that we could've bought if we wanted to just jump in the market and sell it again in a few years. But that's what I did with the condo, and look how great that turned out... We decidedly did NOT want a place as an "investment." Houses are a terrible investment. Your money is tied up unless the market happens to decide you have equity today. You pay twice the price because of interest, and you could lose it all in one big Seattle earthquake. So no investment-based decisions! We wanted a home that we'd be proud of and want to stay in forever, even if we end up underwater on it in the future.

Interstingly, we found that we were very much the demographic at most open houses we went to. The other couples looked like us, were all late twenties to mid-thirties, and clearly had similar incomes if they could afford the same houses and neighborhoods as us. We didn't see very many people with kids even. The rest of the people at open houses were very contractor-y looking, scooping up the investment properties.

At the very end of April, we found one! It was pretty great. Kitchen was a little small, and one less bedroom than we wanted, but it had great updates and some unfinished basement space that we could make in to a bedroom if we needed. We even played with Floorplanner.com after taking some dimensions, and figured out exactly how we'd set up our computer desks and tv. We put in an offer well over asking, with a really big earnest money check, with a letter of how much we love the place, with an escalation clause saying we'd go another big amount over if anybody beat our first offer, and with no inspection contingency because we'd already had an inspection done. Our agent was sure we'd need all five of those. She'd recently seen houses with more than a dozen offers, and anybody with an inspection contingency still in their offer would be ignored. Apparently, the housing industry is roaring again in Seattle.

But we didn't get it. It sold for about $60,000 over asking with eight offers in under a week. It was clearly underpriced but we didn’t think by THAT much.

After that, it was May, and we returned to weekend after weekend after weekend of more houses, more disappointments, lowering expectations, the same homes becoming too expensive for us, and a shrinking buying power. Interest rates were creeping up, so we couldn't look at as much house, plus we had to account for a larger margin beyond asking price to beat out other buyers. We found one that Corey really liked, and met all our on-paper needs, but I just didn't like it and couldn't explain why. That was tough to pass up. (It ended up selling for $30,000 over our max budget, so we'd never have gotten it anyway) We found a few that the agent loved, and also met our on-paper needs, but didn't really appeal to either of us. I was sure I didn't want to increase our location options though. I don't need a big house, so there's no reason to go to the suburbs just so I can get a big house. Location, location, location.

By June, we were starting to really consider buying a more temporary house and selling it in a few years. But then, we found it. :) It listed on a Thursday, we saw it Saturday, went back Sunday with Corey's parents to the open house, got an inspection done Monday morning, and made the offer Monday afternoon. By Monday night, we'd bought a house!

It didn't have very good listing photos, and didn't have any furniture to show you the size of each room, so wasn't one to really draw you in based on the pictures. But when we got in it, the floor plan was great. It's a 60 year old house, but they'd just finished a major renovation on it so everything was new. Being mid-century instead of turn-of-the-century has its perks too, even if it's not quite the same charm as a craftsman. It had an addition at some point so has a great living room in the back that is uncommon for the age and location. It had more than we were expecting: a full laundry room that could really be a bedroom if we ever need another, an attached garage and shop, and carports with a second shop off a back alley, a big kitchen, lots of windows. They'd put a lot of work in to it, and yet, nobody but us really came. We didn't see anyone else drive by the house while we were there (uncommon), didn't have any other agents walking people through (also a bit uncommon), and didn't even see a single other person at the open house (very uncommon).We bid only $1000 over asking based on how little competition there appeared to be, but with another escalation clause, another letter on how much we loved it, another large earnest money check, and the inspection already done.

Not a single other offer came in, and they even pushed back the cutoff for bids by a few hours, hoping more would come. I think just having the bad listing photos turned people off and this house was destined to be ours.

By Tuesday, we were talking again to Quicken, Wells Fargo, and the mortgage broker, and this is where we made our only real mistake. I knew our next step was to get "good faith estimates" from every lender, so Corey went and asked all of them for one by the next day. Apparently, that's not what we should've done at all, because we got a jumble of answers. One just refused to do it - "I can't do that in a day". One got us a pretty close approximation with some disclaimers. And one sent us three different estimates showing different points. ("Points" mean buying down the interest rate. I pay the bank a fee, and they lower the interest rate by a smidge. You can also have the bank pay you and they raise the interest a smidge.) The two equivalent offers - no points - were about the same. One had a little lower closing costs, one had a little lower interest rate. We didn't have the capital for any points, so were just comparing the base values. I was also obsessed with getting the lowest interest possible, so wasn't going to let the bank pay me a pittance to rip me off over 30 years.

Apparently, what we SHOULD'VE done was asked each of them for the good faith estimate on the HUD-1 form. This is a government regulated form that they're required to give you at closing. And by asking for a good faith estimate, we thought we'd be getting it on one of these forms. Not a single one of them told us the much more reasonable answer of "A real good faith estimate takes 4-5 days. If you'd like something today, I can't provide it on the HUD-1 but I could get you a rough estimate". Of course, it would've been way smarter of us to have let them all take a few days to get a real estimate on a standardized form so we could actually compare every entry on the form from all three lenders, but we didn't know. So, our ignorance, and no one telling us otherwise, may have led to us paying more in interest and closing costs than we could've otherwise. I had wanted to take the good faith estimates from two places, show them to the third, and ask for them to match or beat the other two. It was my brilliant plan. But we got such a jumble of garbage that it was hopeless. Next time, HUD-1 estimate or we don't work with you.

We ended up picking the mortgage broker over either Quicken or Wells Fargo. He had the lowest interest, and even if his closing costs were higher than the other guys, we just plain liked him better. He'd been helpful, answered our questions, was local, and replied quickly to everything. He also is well experienced with our agent and with the local filing requirements, so having them all familiar with each other meant a smoother closing, we learned later. If we'd have gotten HUD-1s from everyone, we'd have shown them all to him and had him match it so that he could be the one we did the loan with. Since he's just a broker, he's already sold the loan to a bank, but it ended up being a local bank, not national, and we're really happy we chose him.

After officially picking the broker for our loan, we talked to our insurance company to get the home insurance set up, we went back to the house a few times to take every dimension in the place so we could play with Floorplanner.com again, and to let my dad do his own inspection and approval. An appraiser went out near the end of the waiting period, and reported that it's actually worth $4000 more than we're paying - excellent. In general though, we twiddled our thumbs impatiently for five weeks, with a few short bursts of activity interspersed.

We did find that my name can be on the title, even if I'm not on the mortgage. The title people don't care what the mortgage says, so that was nice.

We had one odd hitch though. The lender is mandated to have access to our taxes returns for the last couple years. Since we file jointly, that includes me. He said they don't actually use it, but they have to get our permission to access it anyway. Looking at my taxes right now could've really messed up our loan because I have two arguments with the IRS going on right now. On my 2011 returns, I had prepaid half my First Time Home Buyers Credit, thinking I'd owe it all when I foreclosed. I learned later that I didn't actually owe it because I took a loss on the foreclosure, so filed an amendment with the IRS to get my money back. They sent me back a letter requesting the forms again, so I sent them again, but that's been ages now and I still haven't heard anything. I've already spent hours on hold with the IRS over the foreclosure, so am not looking forward to doing it again. The other argument is that they think I owe more for my 2012 taxes. They want one last $500 installment for 2012 on the same First Time Home Buyers Credit, despite the fact that the 5405 form clearly says "you do not have to repay the credit" if you take a loss on the sale/foreclosure. They keep sending me the bill and I keep sending them back the form that says I don't owe them. I met with the Bellevue IRS office, and even though they didn't have any authority to make the situation right, they did at least agree with me that I don't owe it. So if they're trying to get a final payment from you too, don't let them!

Anyway, we’re fully packed and are awaiting the arrival of the moving truck tomorrow morning. My credit is repairing itself slowly but surely. I’m about 30 points above my lowest already, and am still about 80 points below my starting score, but ideally I won’t need credit for a long time yet. There are still some people that disapprove, but it doesn’t bother me. This was absolutely the right choice for me and Corey.

It's all been worth it.

- Jane

Monday, March 4, 2013

Day 368: Can I pay my taxes yet? Pleeeeease?

Credit Score: 678

Sorry for the long hiatus! I’ve been planning to write since January but I kept not getting the tax document saying the condo was foreclosed, so kept waiting, kept thinking “it’ll come tomorrow”. But now it’s March and the document has not come. I’ve learned a lot and thought I should finally share, even though I’ve made no progress.

First off, the Mortgage Forgiveness Debt Relief Act was extended by Congress in their fiscal cliff deal in January. It now covers any debt forgiven in 2013 too. I’m sure that’s a big sigh of relief for everyone still waiting for their bank to get their act together. There’s no guarantee it’ll be extended to 2014 though, and with the sequester now in place, there’s no guarantee Congress will pass anything any time soon.

Next up, I learned I did something stupid – not irreparable! but stupid. : ) I did not read the First Time Home Buyer’s Credit documents very carefully. On my 2011 taxes, I paid back half the credit because I knew that I’d have the foreclosure in 2012 and would owe the rest of it. Instead of risking having a large tax credit to repay around the time I may have a very large tax debt to pay, I decided to divide the blow. But now I’ve learned that because I’m taking a loss on the sale of the condo, I don’t owe any of it. That means that of the $3500 I paid last year, I can get $3000 back! (I do still have to pay what was due in 2010 and 2011) I will have to go through the trouble of amending last year’s taxes, but it sounds not too hard. There’s one form to fill out and file, but it has to be filed on paper, not electronically, and it takes a while to get the refund. Totally worth it for $3000 though.

Now, the epic story of my 1099 tax documents for the foreclosure. By January 31st of the year following your foreclosure, you should receive a 1099-A from your bank. It’s not required to file your taxes and just shows evidence that they’ve acquired your property. What is required for your taxes is the 1099-C for cancellation of debt. By January 31st of the year following your cancellation of debt, you should receive a 1099-C from your bank. If those happen in the same year, the bank can skip the 1099-A and just issue the 1099-C instead.

1. Date of foreclosure and date of debt forgiveness are two different things. The bank told me that a 1099-C would take 6-9 months from the date of foreclosure to allow them time to pursue any further judgments against a home owner.

2. The IRS agrees with this. Foreclosure does not mean your debt is forgiven on that date, so the bank can take as long as they darned-well please to cancel your debt.

3. In Washington State, the date of foreclosure and the date of debt cancellation ARE the same thing.

4. Banks don’t care about following state laws until you threaten them. (And maybe not even then)

Here’s how Washington makes foreclosure and debt cancellation the same day -

There are two types of mortgage loans: recourse, and nonrecourse. In a recourse loan (which most states have), the bank can take your house back and demand the rest of the money they’re out. In a nonrecourse loan (which a few states have) they only get the house. However, Washington is neither of these. The debt starts as recourse which means I’m liable for that debt. But then, the bank can choose to either sue me to get their money or take the house – not both. It works like this:

Let’s say I go to my brother and borrow $100 to buy a guitar. I go out and buy it, but when I get it home, I discover it was really only worth $50 so I don’t want the guitar anymore. In a recourse state, I’d go give my brother the guitar and he’d shake me upside down by the heels until all my remaining money falls out. In a nonrecourse state, he’d just get the guitar. But in Washington, he can choose. Does he think he’ll get more value by shaking cash out of my pockets, or by reselling the guitar? By choosing to take the guitar, my brother gives up his right to any money in my pockets. This means that, logically, the debt is forgiven by the conclusion of the trade – automatically and by definition. Therefore, any Washington state foreclosure in 2012 had its debt forgiven in 2012 and was consequently owed a 1099-C by January 31st.

Once I brought that argument to the bank, and demanded to talk to a manager, I got the attention of people who could make things happen. Despite them having already missed six deadlines that they told me they’d meet, including the one the federal government gave them, I’m slightly hopeful that this seventh deadline will actually be met. So I’m giving the supervisor until Monday the 11th to investigate and get me my 1099-C. They say they’ve “escalated it internally” so perhaps I’ll get one.

If not, I can go to the IRS, tell them that, because I’m in Washington, my debt was necessarily cancelled and they can go to the bank and demand the 1099-C. Or fine them, or something… hopefully. I can also go to the state Attorney General and have him look in to it. The bank is ignoring state law by not recognizing that my debt is already cancelled, and that’s what the Attorney General does, isn’t it?

Lastly, I’ve also been watching my credit report closely. My score is up! I’m only down 100 points from the start now. But oddly, it went up just last week because my student loans were reported as $0 owed and closed. Which isn’t right… but I’ll give it another month to sort itself out, then bother to determine what’s going on. Also of interest, my report doesn’t yet reflect a foreclosure. Just that my mortgage is settled. Perhaps that’ll change when the 1099-C is filed? It also says I now have 100% on-time payments again, so that’s great. I guess closing the account/mortgage also effectively cancels your late payment history?

Either way, that’s all I’ve learned for now. I’m still planning another post when I’m really really done. Hope you’re all doing well!

Sunday, December 16, 2012

Day 290: Done! Done! Done!

Credit Score: 652

It’s officially “this time next week” and we’re done! We

moved in to an apartment yesterday and the cat seems happy about having new

windows to look out. We had a very eventful week though.

Tuesday evening when I got home, three notes were taped to

my door. THIS PROPERTY IS NOW OWNED BY FANNIE MAE – one in English, one in

Spanish – and a third note with the contact information of a real estate agent

representing Fannie Mae. That means we’re officially done, our foreclosure

ended in 2012, and we won’t owe taxes! The legal paperwork actually offered us

two options. 1, you could stay in your home and work out a rental agreement

with the real estate agent and new management company; or 2, you could move

out. If you move out and leave the place clean and undamaged, Fannie Mae would pay

some “relocation assistance.” That sounded very intriguing so I contacted the

real estate agent and found out that I could get $3000! Woohoo! That'll be a nice addition to our down payment savings.

A guy met us in the condo on Friday so we could sign the

agreement. It required all the appliances stay, the place to be in “broom-swept

condition,” to have no debts or obligations left over, and we would release

Fannie Mae of all liability or future law suits we might file against them. All

of that sounded great to me except that I wasn’t sure the December HOA dues I

hadn’t yet paid would fulfill the obligation about “no debts.” Since $3000 is a

lot more than the $300 HOA dues, I decided to just pay the HOA, whether or not

I was legally obligated to. We’ll meet the guy again later this week at the

condo so he can verify that we’ve emptied the place, cleaned it, and vacated.

Then we’ll hand over the keys and he’ll hand us a fat check. :) Both of those will

be great Christmas presents.

My credit report doesn’t yet show the foreclosure, but it

should only be a matter of days. The bank has generally been reporting me

between the 14th and 19th of each month. I’m interested

to see if my score plunges again, or just stays level. I imagine after the

foreclosure shows up on my report, my score won’t keep dropping anymore – just a

slow, steady climb back up. And in 2019, it’ll be wiped off my report and all

will be forgotten.

I’m planning one more post, to let you know the final

outcome of my credit score in a couple weeks. But after that, that’s all I had

planned to cover in the blog. Perhaps I’ll record more next year when we’re

looking at houses and loans since there’s so much to learn about the new way of

doing things. We’ll see. Either way, thank you all for joining me on my very

dramatic 2012. Good luck with your own

housing situations; let me know if I can help at all but I’m hardly an expert.

I learned everything from Google and a lawyer, and now have one point of data

on how these things work. :)

Happy holidays. Happy new year. And good luck to all of us

with the fiscal cliff!

Sunday, December 9, 2012

Day 283: Auctioned!

Credit Score: 652

Paper: 38

Email: 3

Voicemail: 48

Email: 3

Voicemail: 48

My auction happened Friday! I took a couple hours off work

so I could go see it happen and verify for myself that it wasn’t postponed.

They said I couldn’t take any photos or video, but I had been planning to show

you what happened.

The auction took place exactly where and when the notice

said it would. The address turned out to be the trustee’s office building, with

the auction happening in their parking garage. Right at 10am, a guy started

reading off a bunch of regulations, probably about the rules of bidding,

consequences, and ownership rules, but he was waaay too quiet to actually be heard.

The forty or so people there had obviously heard it all before so didn’t bother

to stop their conversations.

There were three auctioneers with all the auctions of the

day split up alphabetically by owners’ last name. Mine turned out to be third

on the list for one of the auctioneers. He read someone’s address, read the

minimum bid, asked for any bidders, nobody answered, he read the next address.

He read my address, read off that the minimum bid was the value of my loan plus some extra (late fees or lawyer fees or interest?) for a total of $173k.

There was a booklet that everyone got and it said my appraised value was at

$93k. With that kind of ratio, of course

nobody bid. It would’ve just stuck them in exactly the same position I am, of

being (apparently) $80,000 underwater.

I think that appraisal is a really high. Yes, there are

three units for sale in my complex and their list prices are between 95,000 and 128,000

but the only 2-bedroom units that have actually sold in recent records were

both last month with one at 65,000 and one at 65,400. Another is pending at

66,000, and a fourth is pending short sale at 88,000 but has been very nicely

remodeled (dunno if it’s 22,000 nice, but that’s the buyer’s problem).

I am oddly upset that the appraisal is so skewed, but shouldn’t

be. I wanted the numbers to actually reflect my situation. I am not 80,000

underwater, I am solidly 108,000 underwater. That’s what I’ve been living with

for a year and it was belittled to less than 75% of my real burden. If I had to

pay taxes on that difference though, I would definitely have wanted a higher

appraisal so that less of the loan would have been forgiven. Less forgiven,

less taxable income, less taxes.

Anyway, they read my name, address, minimum bid, asked for

bidders, paused, read the next name and address. There was nothing conclusive

afterwards so that was rather disappointing. There were still a lot of homes

for auction, and mine was done by 10:20, so I left. Maybe something else

happened once they were all done, but I decided I’d rather get back to the

office and keep going with my day. It didn’t really end up being worth my time

to have attended, especially since I came away with zero evidence that it

actually happened, but at least I proved to myself that the auction took place

and was not delayed. The trustee had the right to delay it up until the moment it

was auctioned, so there was always the chance it wouldn’t happen that day.

The auction wasn’t my only adventure since my last post

though. I notified the HOA board that we were leaving and that we would only

own the condo for 7 of the 31 days this month, so proposed that I wouldn’t pay

them the December HOA dues. They could get them from the new owner since they’d

own it for three times longer than I did that month. Before giving them that

proposal, I did check the rules of the association, and looked for anything

that said “HOA dues are the responsibility of whomever owns the unit on the 1st" or something. I didn’t see anything like that though. Just that a late fee

would be assessed on the 15th – after I no longer own it.

Their first response was that if we weren’t paying the dues,

we couldn’t use Cory’s parking space anymore since it’s rented and paid for

with the dues. Fine. He can park on the street. Their second response was “you

have to pay your dues” which isn’t exactly helpful. They started throwing out

numbers and making themselves sound like they knew nothing about

how foreclosures work. Before this started, I wouldn’t have known anything

either, but with how many foreclosures and sales they must have experienced in

the last few years, how can they (and the management company) not know the

rules of who pays dues the month that ownership changes hands?

I asked our lawyer again because we had heard from him back

in our February meeting that some number of months of HOA dues can be tied to

the sale and become the responsibility of the new owner - they put a lien on the

property. When I asked for more clarification from him this week though, after the HOA

started trying to bully me in to paying, he said it was actually dependent on

the year the condos were built. Any condos “built” (I don’t know if that means

permitted, ground was broken, last one was completed, or first one was sold,

but does not mean any of those if it was first constructed as apartments and

later converted to condos - then the

conversion date is what matters) any condos built after July 1, 1990 have the authority to put

the lien on the property and get dues from the new owners. Before that, they

don’t have that authority so it’d mean they come after me for any missing dues.

I’ve no idea whether my building was built before or after July 1, but the

paperwork all says 1990 – the least convenient year possible. I told the HOA

all that information, suggested they find out when exactly these officially

became condos, and that I’d be willing to pay 22% of the month’s dues for the

time I actually own the unit, I’d keep using the parking space, and that if I

could prove to them before the late fee that I no longer own the place, I

wouldn’t be liable for the remainder.

They haven’t answered me since that proposal, so I haven’t

paid yet and Cory’s still using the parking space. He’d rather we just pay the

dues so that it’s not hanging over our heads, but our dues are $330/month. That’s

a lot of money, and if I don’t have to spend it, I don’t want to. I hope to get

an official document posted on our door soon, saying that ownership officially

transferred. Maybe Monday - first business day since the sale? Then I can show

that to the board, prove I don’t own the place, and won't have to pay the dues.

Maybe we’ll still pay the 22%.

We’re moving out in a week though! This time next week, we’ll

be in an apartment. Hopefully we’ll have no mortgage debt, no HOA board still

bullying us for money, no HOA board EVER again, and no worries about a huge tax

burden looming over us. We’ll be closer to Cory’s work, which will make him

much happier, and we’ll be working towards saving enough for a 20% down payment

on a home. The goal is still to buy in June, and if we’re able to save our

average amount every month, we can probably make it. The question will be

whether we can qualify for a loan.

The news keeps telling us that qualifying

for a mortgage is still a huge hill to climb – high credit score, clean credit

history, large down payment, and a low percentage of your income going towards

the mortgage. If we just use Cory’s credit and income, we meet the first three,

but for the loan size we’d want, it’s close to 50% of his income. If we use

both of our credits and incomes, we only meet the down payment and percentage

requirements. I’ll be very disappointed if we can’t buy a home next year, but

getting out from under $100,000 of debt was necessary for our future. Maybe

that future doesn’t include home ownership again soon, but at least it includes

control of our own money, freedom to change our living situation, and a lot

less worry.

Sunday, November 18, 2012

Day 262: The Count Down Starts

Credit

Score: 651

Three

weeks till our foreclosure auction! Our condo is now posted publicly online for

sale and hopefully the bank has published the sale notice in a newspaper like

they're required to do. I'm not really going to complain if they didn't

though.

Since

we're at the final days before no longer owning this place (yay), we went

apartment hunting. We seemed to be looking a little early for people's

expectations, but some complexes had units that would be available for December

move-ins. We definitely wanted to get something solidified for our move sooner

than later. The 20 day window after the sale just seems so tiny to find a

place and move out. Especially when Christmas is in that window. While

apartment hunting, we learned that our biggest priority was still having a

washer and dryer in our unit. Any size, any condition, we had a range of prices

we'd consider, but it'd better have a washing machine. :)

After

visiting a few apartments and condo sublets, we picked a place and signed a

lease! We'll be paying $500 less per month than if we were paying the mortgage

and HOA dues here. Plus, it's in our target home-buying neighborhood. It's

going to be great to walk to restaurants and great for me to learn the much

longer commute. It is about half the size of our condo but it'll be

enough. My in-laws have offered to let us stash all our excess stuff in their

basement for up to a year. We're hoping to not need it that long.

With

the savings we've been able to pocket for not paying the mortgage for the last

10 months, and the savings from a relatively cheap apartment for the next seven

months, we're estimating that we can afford a 20% down payment on a house by

June. Just in time for a ton of houses to come on the market for the

summer.

Unfortunately,

nobody is really offering six-month leases anymore. At least not cheaply. With

the down economy in the last few years and millions of people losing their

homes, demand for rentals has skyrocketed. We signed a one-year lease after

closely examining the lease breaking consequences. I couldn't really believe

that after essentially breaking the lease on our condo, we're intending to do

it again on an apartment, when it really does impact someone else directly -

the landlord. But, the lease breaking agreement was pretty clear. There's a

$1000 fee and we're responsible for rent for any months between our move out

and a new renter moving in. So, we've included that fee and two months of rent

into our estimate for how much of a down payment we'll be able to afford. If we

don't find a home, or find a short sale that we have to wait on, or find a

place that needs some renovations first, maybe we will fulfill the lease.

We'll see.

Despite

the extra cost of breaking the lease, I feel tons better about the foreclosure

knowing that we have somewhere to go. The bank can still postpone it if they

want, though. Even up until the moment the auction starts, they can decide to

postpone. While I don't see why they would, I'm still planning to attend the

auction so I can verify for myself immediately that the auction happens.

Subscribe to:

Comments (Atom)