Credit Score: 752

One whole year in our house today and I have updates for you!

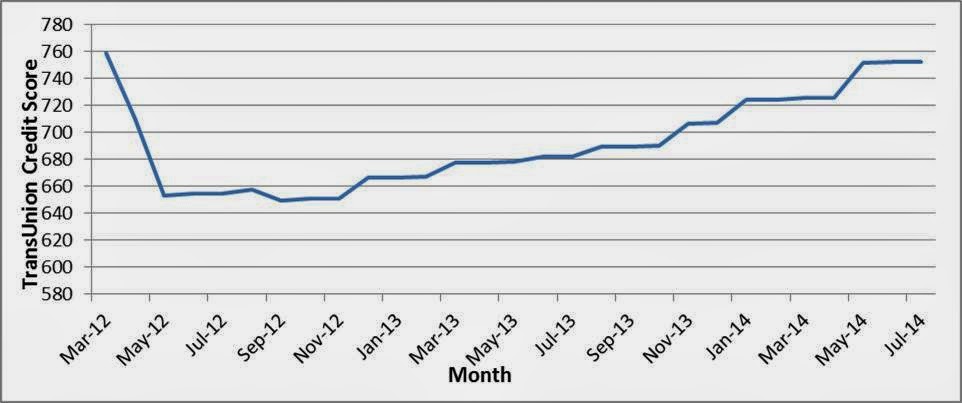

First off, my credit score is back to "Excellent" according to Credit Karma:

It even says I've "done an excellent job" managing my debts. : ) And I'm now only 7 points below my original credit score from over two years ago.

I

pulled my TransUnion report just this month to check how everything shook out. (I

check all three evenly throughout the year - TransUnion was

coincidentally July AND the report that Credit Karma reads.) It does

show the foreclosure, lots of months of missed/late payments and now

shows them as "derogatory marks," but also shows 100% on-time payment

history. OK. Fine by me!

As for the two IRS arguments I mentioned in

the last post, they're both FINALLY resolved, as of last week. How

opportune. I didn't record when the first argument got resolved, but the

IRS did finally agree with me last year sometime that I did not owe them the

$500 for the final payment of the First Time Home Buyer's Credit for 2012

taxes. I continued to exchange letters (with varying levels of

politeness) over the issue of amending my 2011 taxes and my extremely

foolish pre-payment of half the credit. NEVER give the IRS more money

than you have to, guys! I've no idea what possessed me. But after months

of arguing with them, half a dozen letters from me to them, and more

than a dozen letters from them to me including three denials and

two different spellings of my last name, I finally got an interesting

letter a few months ago.

They did not have "enough evidence" to

determine either way. Not enough evidence? Really? Perhaps a result of them

spelling my name two ways, or perhaps bad government record keeping, or

just a consequence of being a large bureaucracy, but evidence is something I can fix! I printed up a copy of every single paper related to

the First Time Home Buyer's Credit, my pre-payment of it, my original

2011 return, my 2011 amendment, a letter of what I again wanted, and

little ink arrows and circles all over each page so they couldn't

miss my point. (It had to be paper because you can't email these guys;

you can't fax them; and when you do call, you just get customer service

who only reads notes on their computers and can't make decisions.)

And

it worked! Or they just got sick of me. Two weeks ago, I got a letter saying they agreed with me,

and one week ago I got a check for the full return of my overpayment

PLUS interest. Apparently I'm entitled to interest for the time the IRS

had "my" money.

Other than buying the sad little condo in the first place,

pre-paying the IRS $3000 was probably the biggest financial mistake I'd

ever made. But now, after a year in my wonderful home and a refund check

safely deposited, I've recovered from both and I sure hope I don't make

any more.

I also hope that this blog has helped you avoid some financial mistakes of your own. Thank you so much for reading!

Sincerely,

Jane

Thank you so much for this blog. I am also in Washington state in a similar situation, as I purchased my home in 2007 when I was young and naive, thinking home ownership was the way to go. I am still underwater and strongly considering just allowing it to foreclose. Do you happen to know the current tax laws in regards to mortgage "income"?

ReplyDeleteHere's the official IRS site for the latest info on mortgage debt forgiveness:

Deletehttp://www.irs.gov/Individuals/The-Mortgage-Forgiveness-Debt-Relief-Act-and-Debt-Cancellation

As of now, the forgiveness is NOT extended for 2014 foreclosures and short sales. Congress has to pass a law to extend it, but they do have until April 15, 2015, technically. They aren't really passing anything at the moment, so it's hard to say what'll happen. Sorry that's not much help!

Thank you for posting this blog... very helpful.

ReplyDeleteagreed, Very helpful. thanks

ReplyDeleteThank you for this blog. I stumbled across it by chance. I havent paid my mortgage in two years... and am still in my condo. My story is similar to yours, as far as a dumpy little condo.... but every day i spend here, i begin to question whether this is the right decision. Too much time to think. I so appreciate hearing about your experience.

ReplyDeleteThis is exactly what I needed to read right now! Your tips are super helpful and easy to apply.

ReplyDeletehomes for sale foreclosure

ReplyDeleteWhat a fantastic read! I love how you’ve presented the information clearly and made it easy to follow.

homes for sale foreclosure