Credit Score: 710

Phone calls: 11

Emails: 2

Paper: 8

The Seattle Weekly news article about us was published today! You can find it here. Cory and I met with Nina Shapiro a few weeks ago when our lawyer mentioned she was looking for people to talk to about strategic defaults. I was cautioned by pretty much everyone that I shouldn't put any more "out there", that talking about defaulting on a blog was already tempting fate enough. Be it wise or not, I like to share when I've found something particularly difficult in hopes that other people won't have to deal with the same issues as me. Any exposure does raise my risk of getting sued by the bank, but that just sounds so unlikely.

Fun that we're even the story opener. :) Nice talking with you, Nina!

I did actually make some progress in non-newsworthy ways over the last

couple days. I was confused back in April when my credit score dropped

because I really had been expecting 90 days before getting reported, plus the bank had only just threatened to report me. Additionally, Credit

Karma continued to say that I was 100% on-time for all my payments. I

didn't really know what was up, but went with it.

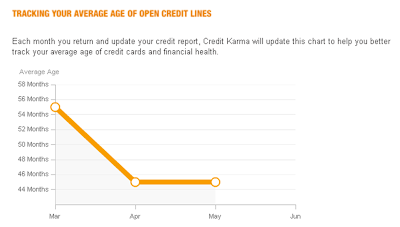

I finally bothered to investigate more, and found this chart on Credit Karma:

My credit score dip was due to opening the new line of credit with the credit union! It took a full four weeks between my credit score rising for getting more lines of credit (and a higher credit limit) and the score dropping for reducing the average age of those lines. Odd. Opening the card was to improve credit in the long run, and I knew that having a company verify my credit would dip it a bit, but I hadn't factored in that a new card would so significantly drop the average age of my accounts. Of course it would, looking back now.

It means I've got a little more credit score excitement to look forward to now. My next free credit report will by July 1, if I follow my self-enforced rationing, so I'm actually looking forward to my score dropping sooner than later, so I can see it in my credit report sooner than later.

We've also now gotten the "we want to help, send us all your information" three full times. - It feels eerily similar to "Resistance is futile. You will be assimilated." to me. - I don't particularly care to send them all my financials, but they seem to think that I'm not sending it because I don't speak English. The latest packet came with a Spanish version as well. :)

First off, thank you so much for starting this blog. I'm also in the Seattle area and bought a house in April of 2009. I understand that helpless feeling of watching what was supposed to be an investment quickly transform into a burden.

ReplyDeleteSince your credit score is going to be a big part of this blog moving forward and if you're a Costco member, you should look into this service: http://costco.identityguard.com. They market themselves as identity theft protection but one of the plan choices is monthly credit reports and scores from ALL THREE credit bureaus. It's fairly inexpensive ($10 for Costco Gold Star members and $8 for Executive). I've been using them for about four years now (after an identity theft situation) and I've been really happy with the service. It looks like the website does a good job of advertising exactly what features are available each month for each plan (this didn't used to be the case).

Good luck!

That is a great idea, and thanks for sharing. I do have identity theft monitoring offered for free through my job, but it doesn't include the credit reports and scores. I'm starting to doubt it a little because it has repeatedly told me, over the last three eventful credit months, that nothing has changed on my credit report. Perhaps it's just looking for fishy changes, and opening a new credit card isn't one of those?

DeleteI'll keep it in mind. :)

Thank you for this blog. I'm in the same boat. Talked to a lawyer a year ago and decided the best option was to default on my condo in Seattle. It's been one year ago this month that I stopped making payments. I also added an option to block numbers from calling my cell phone a few months back. It has changed my life in this process! The calls have completely stopped.

ReplyDeleteI just wish SOMETHING would finally happen. Fingers crossed it does before the end of this year. I haven't even checked my credit score but I've got two credit cards with decent lines of credit. I just did a balance transfer from one to the other in fact, and keep getting offers from them so that's good I suppose. I did leave the condo and rent an apartment, but I keep using the condo's address for all things. It wasn't that easy to rent at first. I got denied at the first place I tried. I moved out after about six months in default to an apartment closer to my job, but I still have stuff at the condo. Unfortunately I still have to pay the HOA dues, that's the worst part. Are you still paying your condo dues? Any advice about that?

Smart to block calls on your cell! I'm expecting at least a year on our foreclosure as well, but there's always a tiny spark of hope that it'll go more quickly. It's sad hearing about other people that are already so far down the line on it and making no progress. Perhaps with the new mortgage settlement, things will start moving?

DeleteIf you're not in the condo anymore, I'd worry about whether the forgiveness bill will apply to you. Maybe having your mail still go to the condo is enough, but we decided against it. If the bill expires, we might move out. No benefit left in staying other than being rent-free after that.

We're still paying our HOA dues, yes. There seemed to be lots worse repercussions on defaulted HOA dues than on the mortgage, oddly enough. The HOA can come after you personally for the amount owed and that sounded like a much bigger hassle than we wanted. We didn't want to get sued by the board cause we've gone to enough HOA meetings to know our board means business and isn't nice about it. I'd say, keep paying the HOA till the sale.

Thank you Jane for this blog post. I found it through the Seattle Weekly article that was just fascinating. I'm not currently in default but seriously considering it with 80K negative equity on what used to be a median-priced home, and we don't want to stay here the 15+ years it would take to return to positive equity.

ReplyDeleteIt's so refreshing reading this story and living vicariously through your experience. I can't believe the only people I feel have publicly supported strategic default are Suze Orman, Professor White, and Donald Trump (of all people!). We need more people looking out for the middle class and what is financially right for us!!!

Thank you, thank you, thank you!

Tom

You're welcome! And thank you. I didn't expect such a warm response from people after doing the article. :D

DeleteLike everyone told me, I’d suggest talking to a lawyer before you decide anything, but Washington is one of the states that makes this easy. I essentially do nothing, pay nothing, until the bank takes their collateral back. The hardest part has been explaining myself to people, and even that hasn’t been too bad.