Credit Score: 758

Number of Emails: 1

Phone Calls: 1

Paper Mail: 0

Day 15 marked the official missed-the-payment-entirely line. Sure, it was due on Day 0, but Day 15 marked the end of the grace period and the first appearance of a late fee. It was preceded by a phone call that my payment was almost late, and followed by an email that my payment was officially late.

Part of this economic adventure has been realizing that I don't want to be with a bank anymore. I don't want my money sitting with a company whose whole intention is to make money off me. I don't like that my bank had to take a bailout, that they consider adding fees to necessities like debit cards, that their executives get ridiculous bonuses while their customers suffer, and that they're a rather heartless business. I'd rather pull my money out of the corporate goliaths and bring it local. I have joined my husband's credit union and am working on moving all the bills over to that account. Everything from my paycheck to the power bill will start going through his/our credit union. We had not joined accounts since getting married yet, so this was a perfect opportunity.

Knowing that I don't want my money with banks, I also knew I didn't want my new credit-boosting credit card to be with a bank or major corporation. So I joined a second local credit union. I learned that I can't join without some money being in their accounts, but I only had to have five bucks in an account to get the credit card. I opened a basic savings account, no bells or whistles, and applied for a credit card.

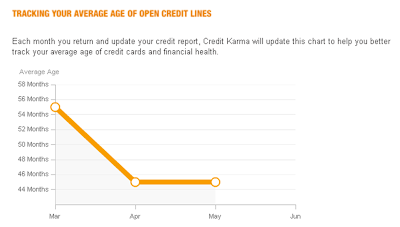

They did a soft-check of my credit score to open the savings account, and a hard check to open my credit card. My credit score actually did not budge at all despite the hard check and a new higher credit limit. Not yet at least. I was approved for their lowest interest rate on their only credit card, and the teller said she'd never seen anyone actually qualify for that. :) While it's good to have great credit and reap those rewards, I'll soon be like the rest of her customers and won't look so squeaky clean. That's why I'm doing this now - before my score drops for other reasons and to use that time dropped to recover simultaneously. That hard credit check will stay on my credit history for two years, but since it appears to have had no effect, no big deal.

I decided that since my credit score didn't move in the slightest, it's not worth getting a second new credit card. Maybe if I'd seen it jump a few points for having doubled my credit limit, it'd be worth considering tripling my credit limit. The hassle of a fourth institution (2 credit unions, 1 bank, +1 new) handling my money isn't worth it – not to mention a fourth username/password pair! If I was still going to get a third card, it'd be with the third credit union I qualify for through my job. I believe I've maxed out potential credit unions at that point though.

Once I get all my bills sorted and have verified that they've all transitioned to the credit union for a month or two, I'll close the bank account and move that cash to the new savings account. It'll be wholly in my name, so on the small chance that Cory runs off to Canada with some cute indie hipster chick and takes all our newly-joint money, I'll still have something for me. Moving all my money will also - and more practically - mean the mortgage company (who is luckily different than my bank) will have no access to my money and will not know where it is. I had been previously worried that they'd pull money out of my account despite me no longer authorizing it, but since they haven't yet, I'm not worried anymore. That would be literally stealing, and while I have very little respect for my mortgage company, I do think they're above stealing (money at least, not houses).

Cory and I will also start actually using our credit cards. Till now, we've only been using debit, seeing no need to insert more people in to the process and having no need to carry a balance ever. Now though, I've gotten some tips on when it really is better to use credit: (1) any time the card leaves your sight, (2) you don't have your purchase already in hand, or (3) at particularly vulnerable locations. From now on, we'll use our credit cards at (1) any restaurant that takes your card away from the table, (2) any time we order something online, and (3) at all gas stations. This way, we'll have protection from unauthorized purchases (1&3) and protection from incorrect/damaged products (2). We'll aim to stay below 10% of our credit limit on each card per month, to maximize the credit score benefits of using the credit card.

In the next couple weeks, I imagine the phone calls and emails will be more prevalent. Perhaps paper mail will show up. And I'll find out if Day 30 brings a drop to my credit score, or the first phone call + 30 days, or the late fee + 30 days, or some random date that they finally get around to reporting me.